Depreciation of the Lanka Rupee

Was the 2022 March rapid depreciation of the Sri Lanka Rupee(LKR)

against the US$ unexpected or a result of Foreign exchange policies

adopted by CBSL since 2005 to keep the depreciation at a rate much

lower than the observed trend since 1977?

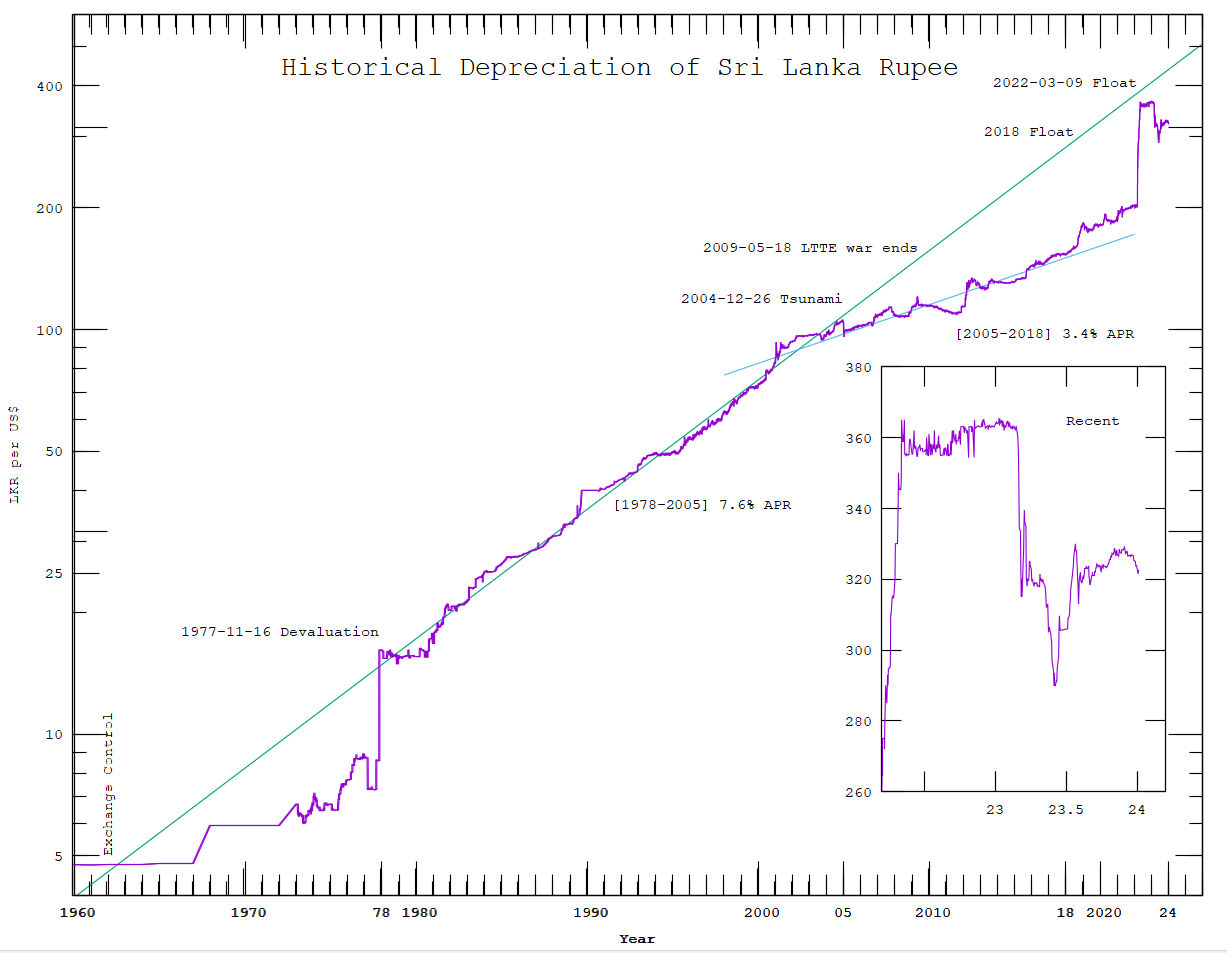

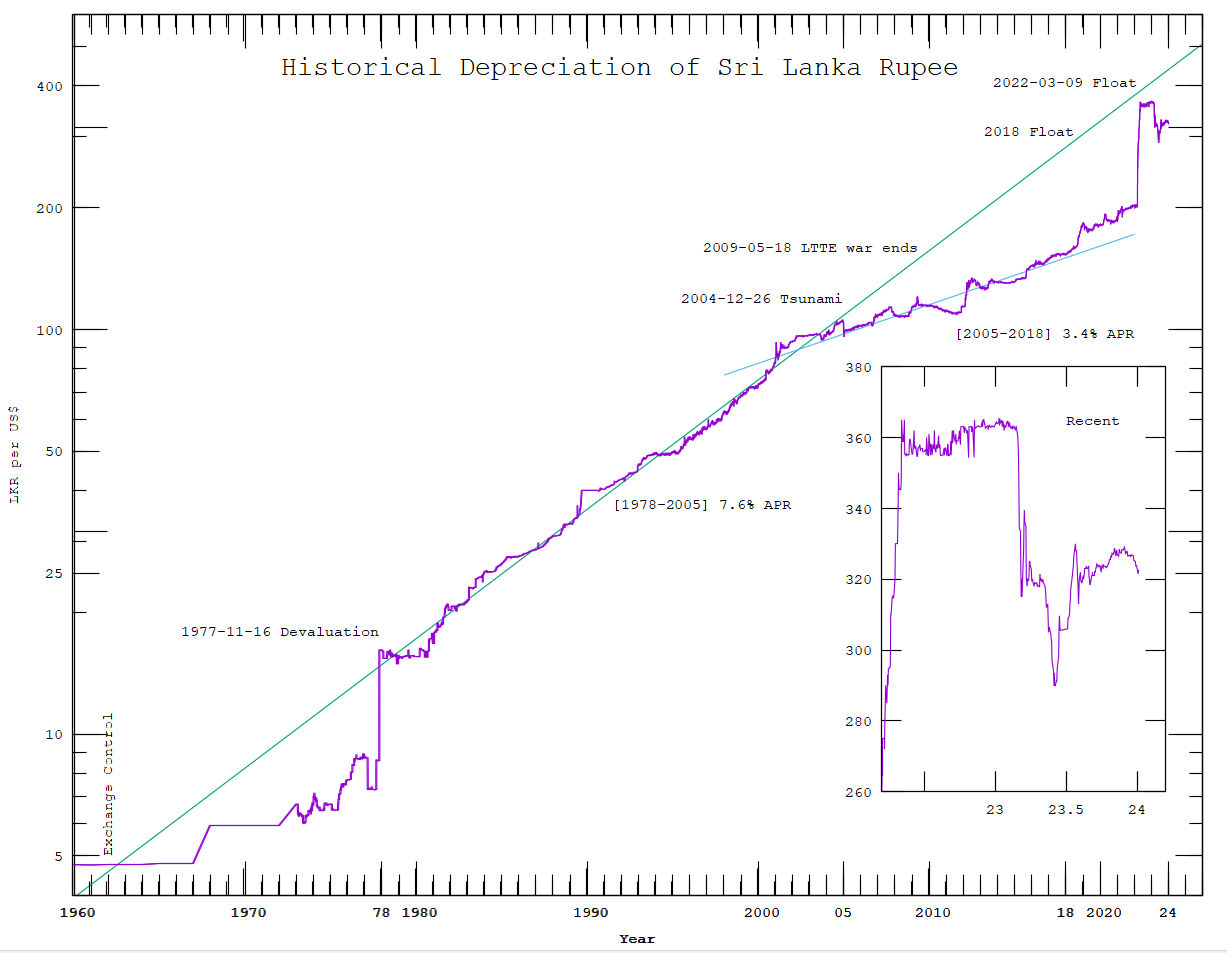

The historical depreciation of the Sri Lankan rupee since exchange

control was introduced in the 1960s is depicted in this time series

graph. The exchange rate per US$ has been plotted on a logarithmic

scale to clearly illustrate the full range of values from Rs4 in the

1960s to the current Rs360, and the rate of change of depreciation.

The early 1970s was an era of strict exchange control, when you could

get only a few dollars when travelling abroad, various devices like

Foreign Exchange Entitlement Certificates FEECs which effectively

created two different exchange rates. The value of the Rupee was

devalued from Rs8.60 to Rs16.13 on 1977 Nov 16th by the JR Jayawardena

government to open the economy. Over the next 27 years the Rupee

depreciated at an almost constant rate of about 7.6% per year with

respect to the US$. Although it can be seen to deviate from the fitted

line on occasions, it always seems to come back to this trend line

within about a year. When you extend this trend line back it cuts the

value in the early 1960s when exchange control was first

introduced. The 90% depreciation in 1977 appear to be catchup for

about 15 years of strict exchange control,

This trend continued till 2005 when the devastating Tsunami of 2004

December, brought in so much foreign aid that the exchange rate to the

US$ dropped very soon after, from Rs105 to Rs95. Since then over the

next 13 years the Rupee depreciated at a much lower rate of 3.4% per

year. Ajith Nivard Cabraal took over as Governor of the Central Bank

in 2006 July and maintained the lower trend even though Sri Lanka

still had an ongoing civil war with the LTTE. When this war ended in

2009 May, the Rupee appreciated by 5% over the next 2 years. Did CBSL

release more US$ to maintain an exchange rate lower than the natural

trend? The CBSL may have wanted to reduce the amount of rupees that

needs to be paid for the foreign exchange remitted from abroad by the

large number of migrant workers, which was supporting our economy.

With a Rupee depreciating less, Sri Lanka was able to show an apparent

higher rate of increase in the GDP and migrate proudly from a low

income to a middle income country. With a GDP over US$4000 Sri Lanka

lost the ability to get loans at a lower interest. After the

Government changed in 2015 January, many irregularities, such as

hidden foreign debts were exposed and compounded with a Bond Scam the

Financial Rating for Sri Lanka dropped, and the cost of borrowing

money increased. In 2018 the Rupee was depreciated 19% from Rs153 to

Rs183 to the US$, with Indrajit Coomaraswamy as Governor of CBSL. In

2021 July, Basil Rajapakse entered parliament via the national list

and was made Finance Minister. In 2021 September Ajith Nivard Cabraal

resigned as national list member in Parliament and became Governor of

CBSL again.

CBSL maintained a non-credible peg at Rs200 to the US$. In 2022

January they paid back a Sovereign Bond of US$500 million and

interest, despite all economic indicators that CBSL could not afford

to do so. CBSL anyway defaulted on their Sovereign Debt in March. For

many years the Kerb rate had been only a few rupees different from the

official rate, even less than the selling rate of some Banks. From

about 2021 September the Kerb rate started to increase and Undial and

Hawala transfers got well established. The amount of Foreign exchange

remitted

through legal channels decreased to about 35% YoY by 2022 February. By

2022 March the Kerb rate was Rs250. When the exchange rate was floated

on 2022 March 9th, CBSL hoped it would settle at about Rs230. However

it rose rapidly to Rs365 in 2 months when CBSL removed the float and

pegged it around Rs360. The exchange rate had almost caught up, what

it would have been if the previous long term depreciation had

continued from 2005 as shown on the graph.

Both Cabraal and Basil, blamed for the financial crisis, resigned in

early April. CBSL has however confirmed in an RTI, that banknotes

dated 2021-09-15 were printed with their signatures and came into

circulation in 2022 August.

The Aragalaya was not amused.

The rapid depreciation by 80% in two months has created over 100%

inflation in food prices, and a loss of trust in the Sri Lankan

rupee. Assuming that it will precipitate a depreciation like in

Venezuela or Lebanon, it has made those with significant rupee assets,

decide to try to change it to US$ at whatever cost. Therefore the Kerb

rate has remained Rs 30 to 50 above the official rate. Most of this

Foreign exchange never reaches Sri Lanka, as it is accepted in cash

overseas and LKRs are paid in cash directly to the recipient at their

home, avoiding any record in the banking System. Although CBSL has

outlawed it, such exchanges in cash are impossible to track. Over the

last year Sri Lanka has lost over US$4 Billion from Foreign

remittances.

A year later in 2023 March when the IMF loan was just about to be

approved there was a sudden appreciation of the Rupee, as seen on

graph above. All those that had purchased or not converted US$, an

year earlier, when the rupee was rapidly depreciating, started to sell

creating an appreciation of 11% in 1 month stayed steady and dropped

another 9% or a total of 20% before starting to depreciate again.

It is reported the central bank got US$½B which they purchased

with Printing LKRs. What will happen next although uncertain, I

suspect will be a another depreciation later this year when Sri Lanka

starts to repay its foreign debts.

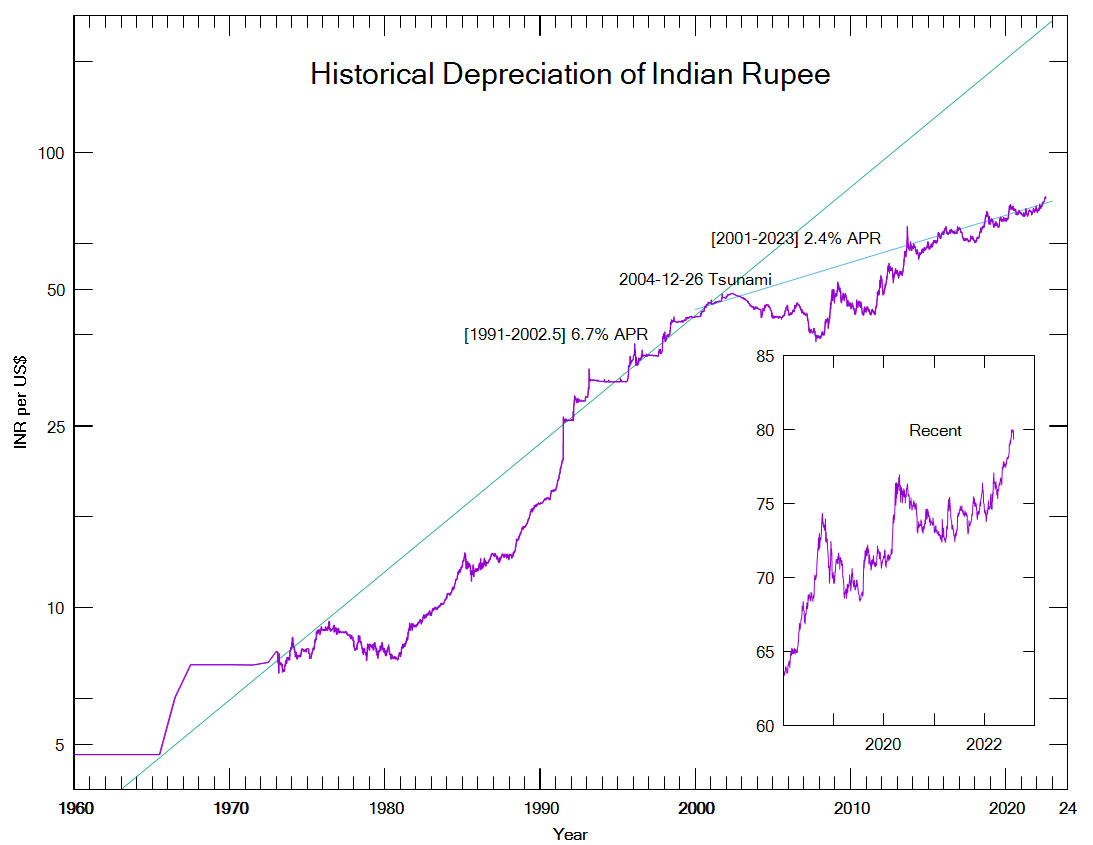

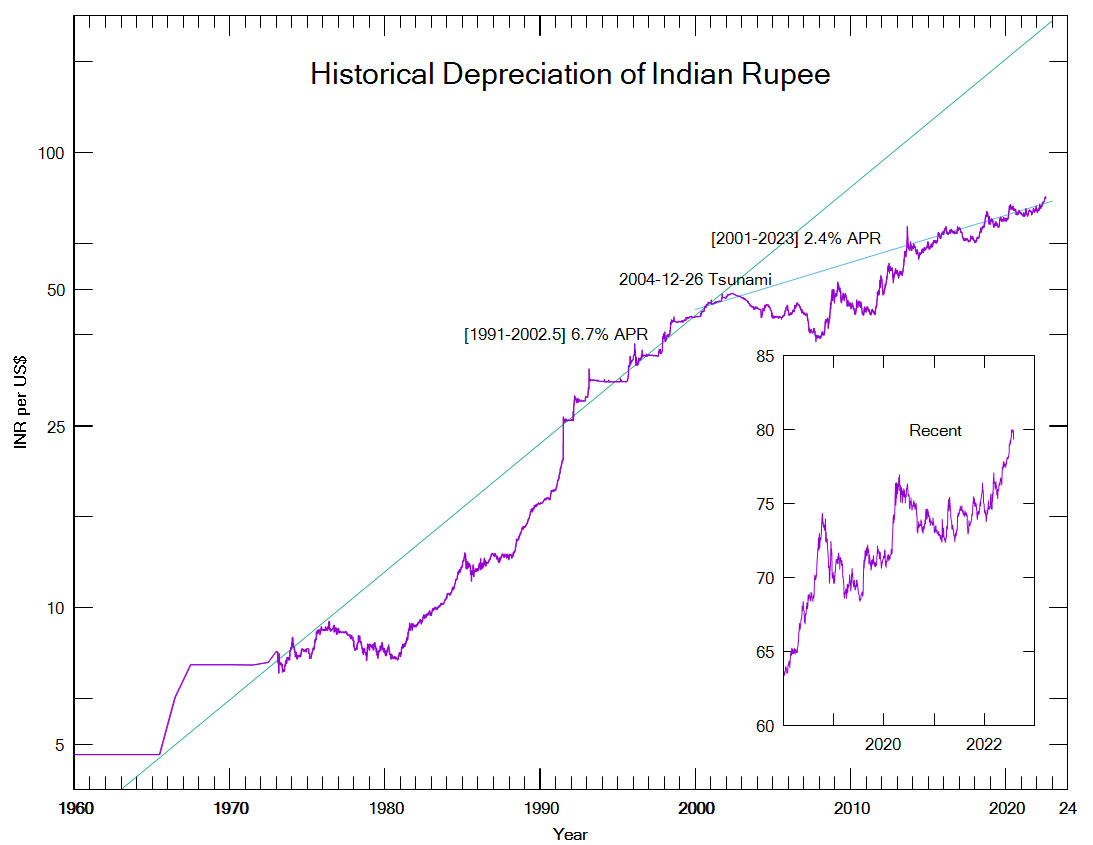

The natural trend is just an observation that I will leave to the

economists to explain. There are probably many factors that need to be

considered to properly understand its cause and effects. For example

the Indian Exchange rate to the US$ also shows a lower rate of

depreciation after year 2000 and may have influenced the Sri Lanka

depreciation as our trade and economy is strongly dependent on India.

The natural trend is just an observation that I will leave to the

economists to explain. There are probably many factors that need to be

considered to properly understand its cause and effects. For example

the Indian Exchange rate to the US$ also shows a lower rate of

depreciation after year 2000 and may have influenced the Sri Lanka

depreciation as our trade and economy is strongly dependent on India.

The way out of the shortage of US$, by the exchange rate remaining

much lower than the natural trend, has still to be worked out. The

catch 22 situation is that this shortage of foreign currency will not

improve till foreign remittances return to previous levels, and that

will not happen till the Economic combined now with a political crisis

is more stable.

The 2022 August version of this web page was published in the Sunday

Times of Sri Lanka on 2022 August 7th, Page 18

The historical depreciation of the Sri Lankan rupee

and reference by the Editorial

People participation and transparency in public finance

in the same issue.

Daily Exchange rate Data was obtained from

Federal Reserve Bank

and archive of older data on FRB saved at

archive.org

FRB publishes Exchange Rate data of

24 countries

including only India and Sri Lanka from South-Asia.

Section 522 of the amended

Tariff Act(P142-143) of 1930 does not specify the currencies

needed to be certified by the Federal Reserve Bank of New York for

customs purposes. There are 180 currencies in the world circulating

197 countries of the World Today. Inclusion of Sri Lanka among the 24

selected must reflect the former importance of the Ceylon Rupee.

This web page and Graph was originally posted online since around in

1996 and updated daily till 2004 September using my plot program demon

(developed mongo) via an automated crone script on a UNIX server. I

saved that last web page as it was when

I left the USA and retired to Sri Lanka. Being unfamiliar with

MicroSoft eXcel I asked for help from many persons but didn't get a

satisfactory Graph. Finally I spent time trying to do so myself

starting with a version created for me by my research assistant Kasun

Jayasuriya. I convinced myself that excel just does not have the

capability to do so. On a suggestion of Dr Nalin Samarasinghe now

replaced with graph made on 2022 August 9th using gnuplot.

gnuplot was now much improved and more user friendly, since I had

tried it many years ago. This page will now be updated when there

is a significantr change in the exchange rate or weekly if and when

I am able to develop a script using lynx, awk and sed to do it automatically.

Kavan Ratnatunga 2023 October 30th

The natural trend is just an observation that I will leave to the

economists to explain. There are probably many factors that need to be

considered to properly understand its cause and effects. For example

the Indian Exchange rate to the US$ also shows a lower rate of

depreciation after year 2000 and may have influenced the Sri Lanka

depreciation as our trade and economy is strongly dependent on India.

The natural trend is just an observation that I will leave to the

economists to explain. There are probably many factors that need to be

considered to properly understand its cause and effects. For example

the Indian Exchange rate to the US$ also shows a lower rate of

depreciation after year 2000 and may have influenced the Sri Lanka

depreciation as our trade and economy is strongly dependent on India.